Real Estate Blog

Real Estate Blog Real estate

Real estate Investments in real estate in Ukraine: basic rules for an investor

Investments in real estate in Ukraine: basic rules for an investor

Investing in Ukrainian real estate – promising direction for those, who plans to increase their capital in the long term. More and more Ukrainians prefer this method., as a replacement for standard bank deposits. This is due to the fact, what such property is not subject to inflation and is a reliable investment, though not super profitable.

In this case, the amount of entry is large, therefore it is necessary to carefully approach the selection of the object, assessing all risks and potential profitability. In this article, real estate expert with over 25 years of experience Alexandr Tsvigun will tell all the subtleties of the question, which will be useful for both beginners (from scratch), and for experienced investors.

Before, how to invest the accumulated finances in an apartment or commercial space – it is necessary to build a clear strategy and set clear goals. The built strategy will help you see the perspective and expected results.

Ask yourself a few questions:

If all these questions are answered – positive, then go to next item.

Currently, real estate investment is divided into depending on 2 parameters: type of acquired object and purpose of investment (type of income generation). Having decided on this issue – it remains only to decide on the object itself and purchase it.

There are two options: residential and commercial. They differ in both payback period, complexity, and other nuances, you need to know. There is also a choice in the way of earning income. – lease or sell after a few years, at an increased price. These methods can be combined with each other..

This type is the most popular and simplest possible..

Residential property includes:

The best option would be to invest in an apartment, which is located in a residential complex under construction. The main reason for this – Lower price. When the LCD is put into operation, infrastructure is being established – the cost of housing in this house increases. Usually, at this stage, the sale of previously purchased apartments is carried out, to fix profits, but many also do it a few years later.

The return on investment in residential real estate depends on various factors, but on average, a good result is considered 8-10% annual.

Commercial real estate is also in demand on the Ukrainian market, especially in large and resort cities, such as Kiev, Odesa, Lviv. For instance, if we consider the acquisition real estate in Odessa – more profitable would be the option with a room for a cafe or restaurant.

Commercial real estate includes:

Basically, commercial real estate is purchased for the purpose of subsequent lease for a long-term period – this is the most profitable way to return your investment and gain a profit. It is important to remember about the need for maintenance of the premises., overhauls and taxes – these are additional items of expenditure.

The essence of this method is to make a profit on the difference in value at the time of purchase and at the time of sale.. To this end, usually buy residential properties, due to the increased demand for purchase in comparison with commercial (they are more often rented).

Main advantages:

It is recommended in this case to purchase apartments in residential complexes, which are at an early stage of construction, until the price has gone up. It is important to study all the documentation and the legality of the construction, to prevent further problems.

Average, at the time of sale the cost of the apartment higher from initial to 20-30%, this figure is the approximate resale profit.

For that, to benefit from the apartment, it is important to choose the correct region of the country and district in the city. Increased demand for rent is relevant for housing near educational institutions (colleges, universities, institutions) at the expense of visiting students and in tourist cities (Kiev, Lviv, Odesa) at the expense of vacationers in season.

Main advantages:

Recommended reading: How to rent an apartment in Ukraine: expert advice

According to the Ministry of Finance average payback period of an apartment, which was bought for rent, as of 2019 year – 7 years old.

Income from investments in real estate, depends on various factors. In this case, Consider the potential profit from the resale of your home, bought in a new building.

As mentioned above, selling an apartment after commissioning , which was bought in the residential complex at the excavation stage, you can make a profit up to 30%. But, there are many other cases, when the percentage rose to 60-70%.

For example, imagine the situation: in 2023 year was bought an apartment far from the city center, without walking distance to the metro. Across 2 a large shopping and entertainment center was built nearby, and after 5 years old – subway station. In this situation, you can sell the object much more expensive, than planned.

Factors, affecting the value of a residential property:

This is a basic list, which you need to focus on when selecting, the full list is much more. We recommend that you contact an experienced specialist, which will help to analyze offers on the market and choose the best option.

When calculating the cost of selling an apartment, you must be guided by similar offers in nearby houses, which have already been commissioned. It is recommended to initially lay a few percent of the cost for the auction.. Eventually, for an approximate calculation, it will remain to subtract the amount of invested funds (including associated costs) of the estimated sale amount.

An additional factor is taxation on the purchase or sale of an apartment – this must be taken into account when calculating the final profit.

Recommended article on the topic: Taxes on real estate transactions in 2021 year

Risk assessment – critical stage, which cannot be dispensed with when investing in real estate. Ignoring any important factor, you can completely lose your investments or simply not get % arrived.

Not worth buying a home, if:

To assess the risks and potential of the investment – contact our expert, which will analyze in detail the presence of negative factors in a particular object and prompt, how to proceed.

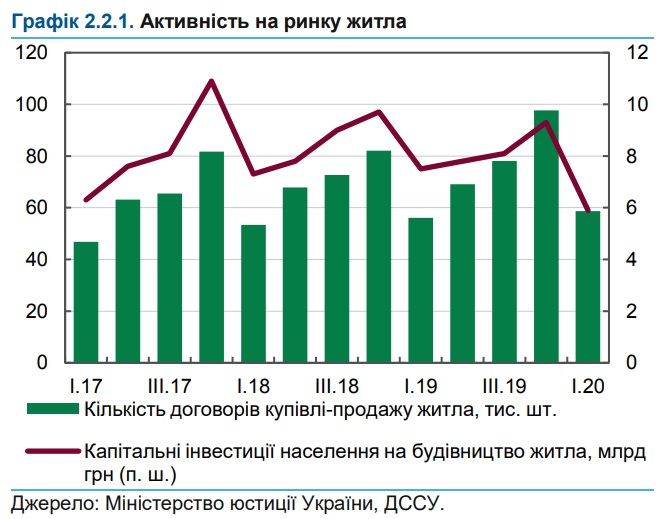

Even despite the negative dynamics of demand for the purchase of housing in Ukraine in 2020 year – real estate investments are more stable and profitable in comparison with bank deposits.

According to the Ministry of Justice of Ukraine – due to the pandemic, the purchasing power of citizens and demand fell by about 40%, but this creates deferred demand – when the situation is stabilized, Ukrainians' interest in new housing will increase.

When choosing where to invest the accumulated financial resources, it is worth considering, that the NBU gave a forecast of a decrease in the interest rate on deposits, what makes real estate even more attractive in this matter.

For advice and assistance in the acquisition of real estate for investment in Odessa – contact the specified contacts on our website, our experts will help you every step of the way: from the selection of an object for purchase, before selling or renting it.

During the first two years after the start of the large-scale invasion, the real estate market in Ukraine experienced temporary stagnation, however, he quickly began to adapt to the current circumstances, forming new priority areas.

With the beginning of a full-scale invasion 24 February 2022

in 2023 about a year 50% apartments, acquired